A real estate purchase agreement, also known as a “Sale and Purchase Agreement (SPA),” is a binding contract that outlines the terms of a real estate transaction. The document is completed by a buyer, who presents the completed document to a home seller as a means of “making an offer” on their property. The seller then has the option of accepting, declining, or negotiating the offer and conditions presented by the buyer.

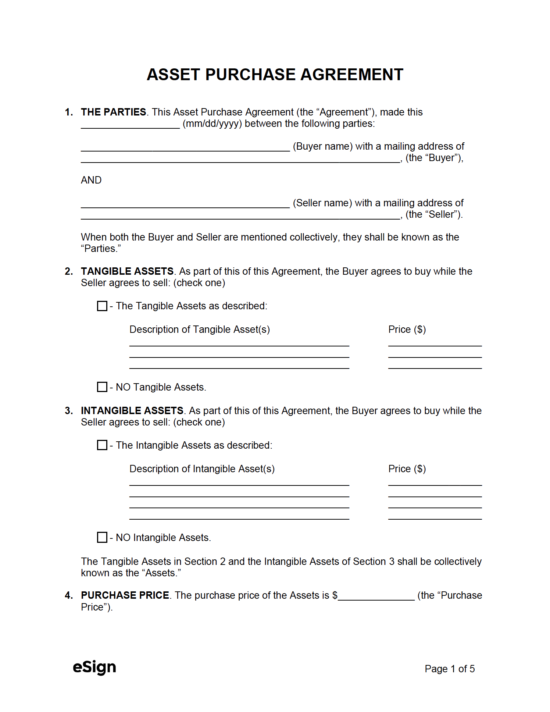

Asset Purchase Agreement (APA) – A document completed when a party will be purchasing some (or all) of a company’s assets. Assets can include equipment, software, licenses, know-how/processes, inventory, and more.

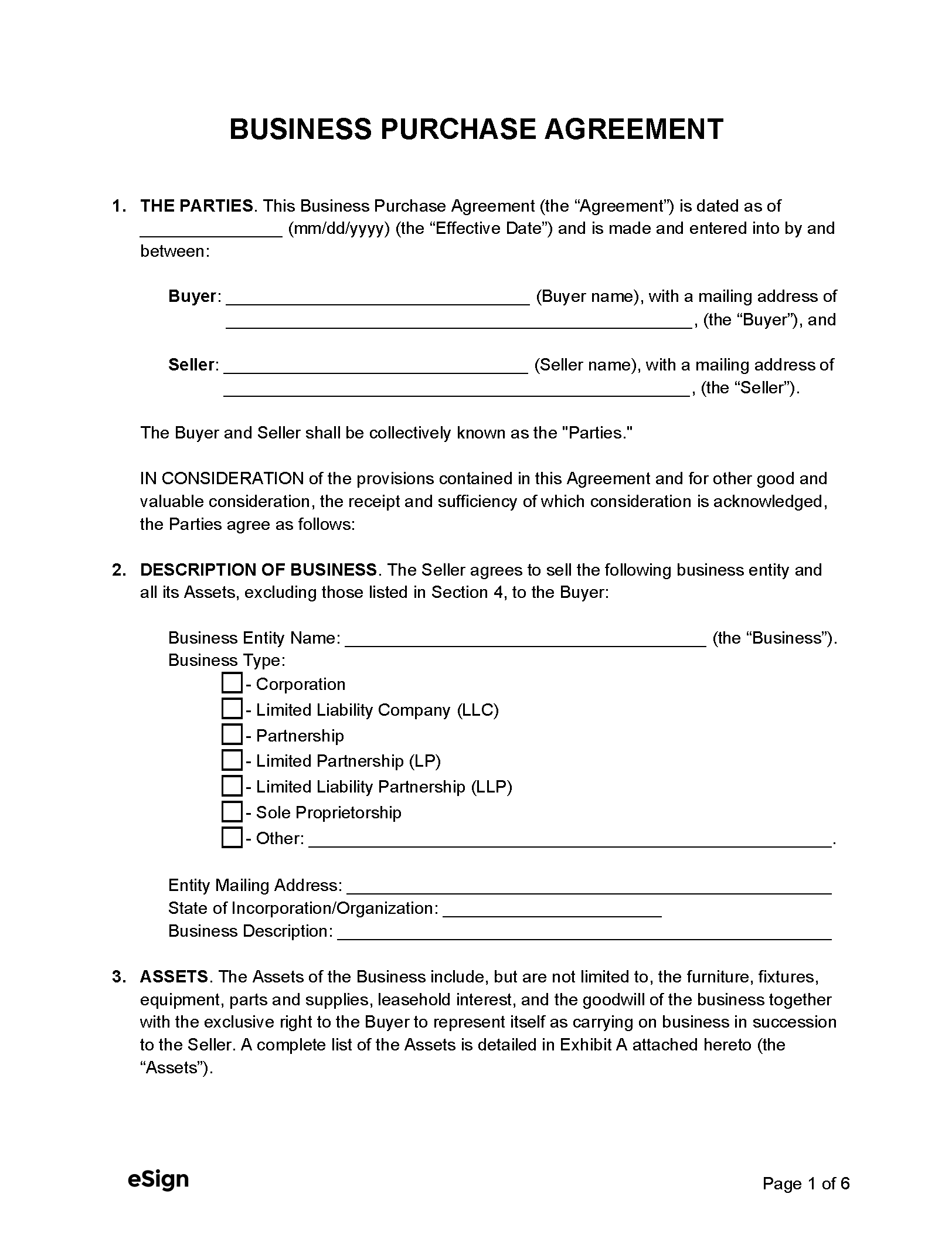

Business Purchase Agreement – A contract used to outline the sale of a company between a buyer and a seller.

Car (Vehicle) Purchase Agreement – Also known as a “bill of sale,” this form is used to legally document the sale of a new or used motor vehicle.

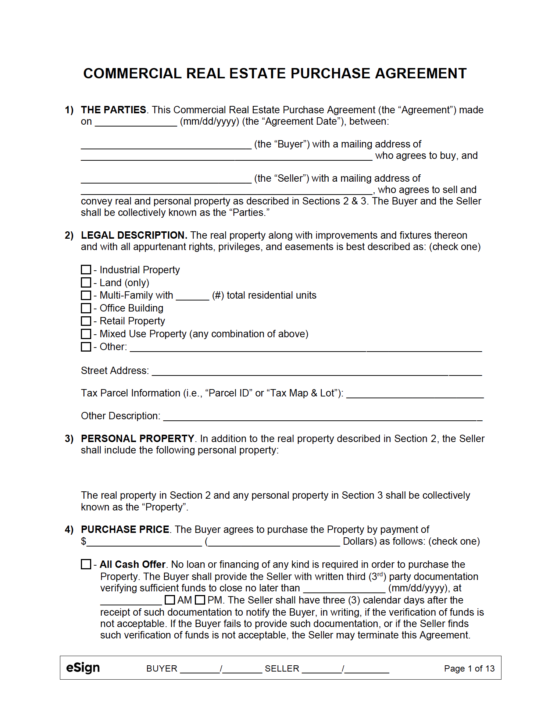

Commercial Real Estate Purchase Agreement– Establishes the terms and conditions for the sale of a business-only property (e.g., retail, industrial, office space, etc.).

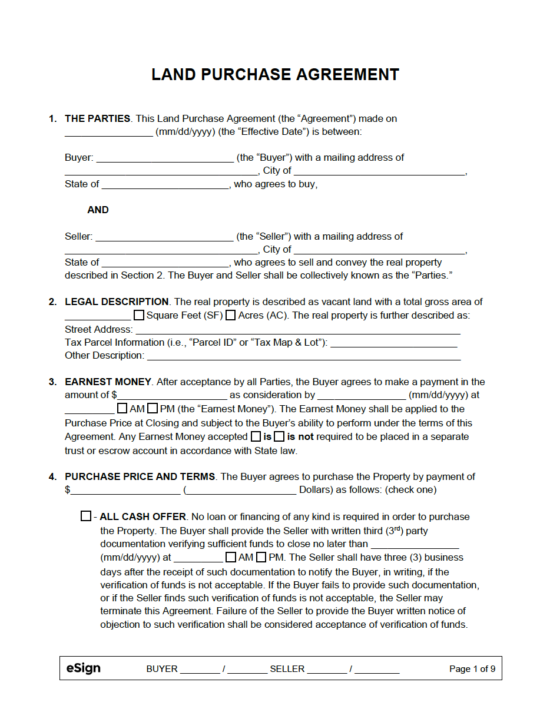

Land Purchase Agreement – For structuring a deal in which land is sold from one person (or entity) to another. Can be used for residential, commercial, agricultural, or mineral development.

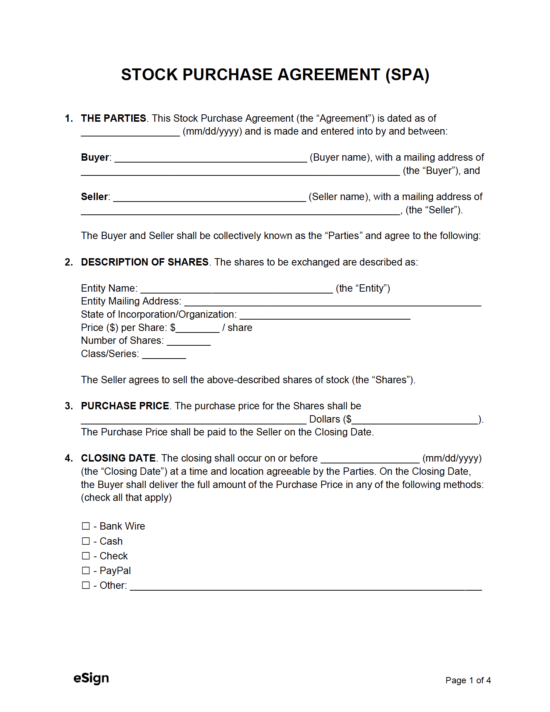

Stock Purchase Agreement – A contract used for selling shares of stock of a company.

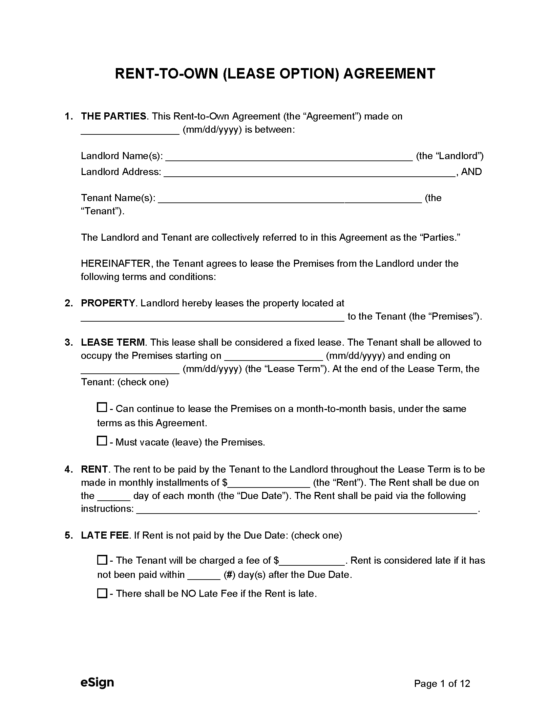

Option to Purchase (Property) Agreement – A rental form that combines a fixed-term lease with a purchase contract, giving the tenant the ability to purchase the rented property if they so choose.

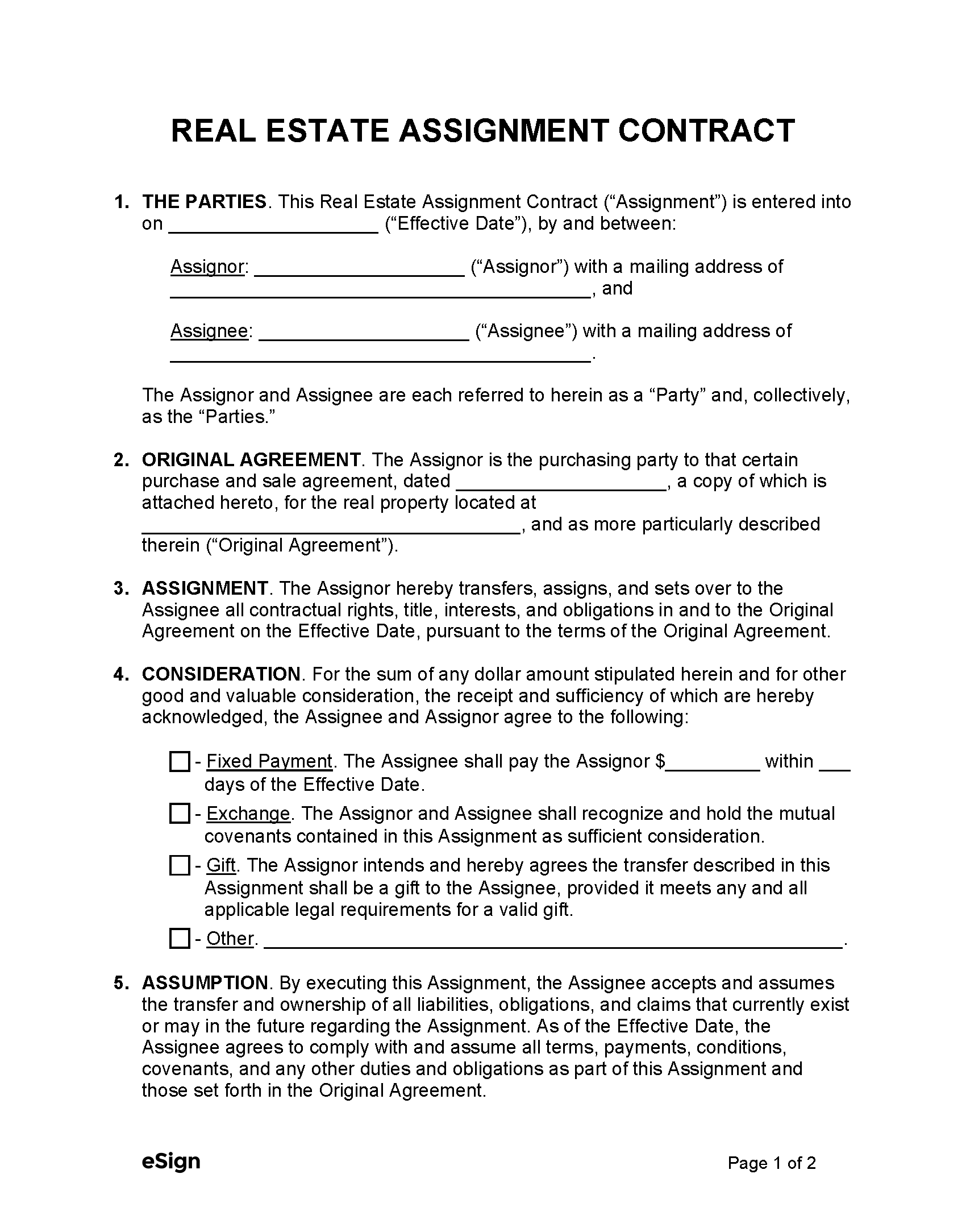

Assignment of Purchase and Sale Agreement – Allows the buyer to transfer their purchasing rights and obligations to another party before the initial closing date.

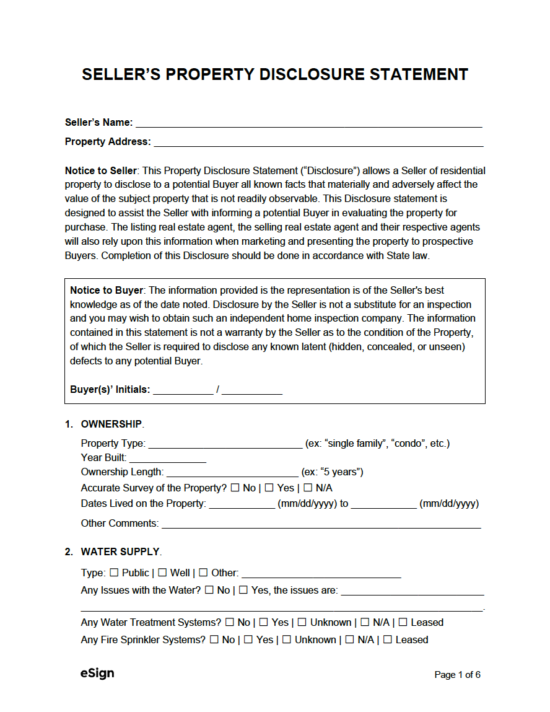

Residential Property Disclosures (50 states) – Provided to potential homebuyers to inform them of both existing and previously repaired issues on the property.

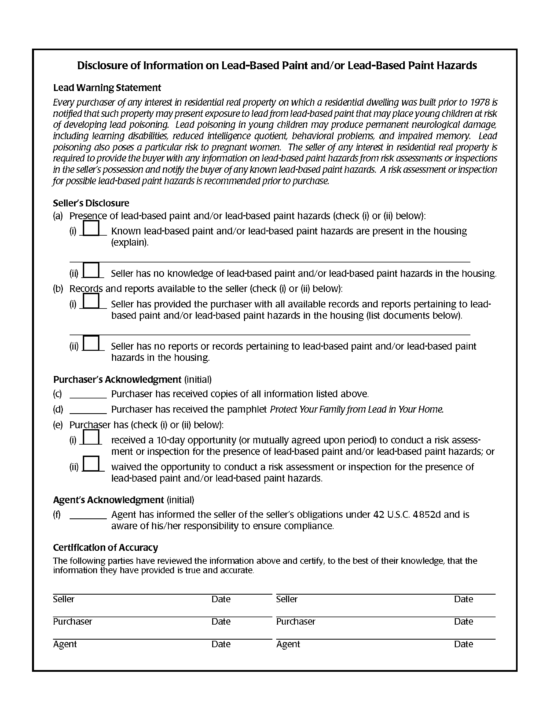

Lead-Based Paint Disclosure – Must be given to potential homebuyers if the property being sold was built prior to 1978.

A purchase agreement is a form used for making an offer on a home. It contains a set of conditions and contingencies that are presented to the seller of a home, who will either accept, deny, or counter the offered price, and may wish to negotiate some of the conditions included in the contract. If the seller accepts, the seller and buyer will sign the form, officially making the agreement “under contract.”

The following guide is a general outline of the home buying process for residential properties.

The first step prospective homebuyers should take in the buying process is to identify exactly what they can and can’t afford. After all, there is no sense in finding the “perfect” home only to find out that it’s out of the buyer’s affordable price range. There are several important things that the buyer will need to get in order before they consider purchasing a home.

The Downpayment – A buyer should reserve a minimum of five percent (5%) for a downpayment on a home. However, the higher the downpayment that the buyer can make, the better it will be for them in the future. Paying a greater down payment (15%, for example) will accomplish the following:

Credit Score – In short, the higher the buyer’s credit score, the better the mortgage rate they’ll be able to get. Additionally, they’ll be able to take out a greater mortgage with less money down (if they so choose). In general, a credit score above 660 will allow buyers to acquire a home loan, although a score above 700 should be strived for.

Income & Expenses – While amassing a significant sum for a downpayment will reduce the loan amount and the rate, the buyer will still need to afford the monthly payments involved with the loan. The buyer should take a hard look at their income and expenses to ensure they will be paying no more than forty percent (40%) of their income towards all of the home expenses. Home expenses take into account insurance, taxes, and other related costs.

SmartAsset “How much house can I afford?” Calculator – This is a useful tool for prospective homebuyers for getting an estimate of the home price they can afford.

A pre-qualification letter is an official form given to a potential buyer by a bank or mortgage lender. It is provided after the buyer submits their income, assets, and expenses, and provides them the necessary information for pulling up their credit score.

While not a technical requirement, obtaining pre-qualification can open up many more doors during the research and touring stage, and make sellers more interested in showing their property. With that said, it is not a guarantee . Just because a buyer acquires a pre-qualification letter doesn’t mean it is guaranteed they will be able to obtain a loan.

According to Zillow’s Housing Trends Report for 2019, eighty-two percent (82%) of home buyers used a real estate agent or broker to assist with the home buying process.

Why use a realtor for buying? Some of the more common reasons include:

Prospective buyers can use some of the following methods to find a realtor:

With the help of their agent (assuming one was hired), buyers can begin searching for a home. The buyer should create a list of “must-haves” to narrow down the scope of properties to a more manageable list. On the other hand, buyers should avoid being overly picky to avoid unnecessarily limiting their options. Informing the agent of their specific interests is highly recommended, as they will conduct research on their own time and know exactly where to look. The following are platforms for finding homes for sale:

Once the buyer finds a home they’re interested in, they can ask their agent to set up a private showing of the property.

If the buyer takes a tour of a property that they like, and they want to more forward with negotiations, they will complete a purchase agreement. The form serves as an offer, informing the seller exactly what the buyer is willing to pay, what contingencies they have (if any), and the other aspects of the arrangement. If the seller deems it to be a fair offer, they’ll accept it. However, buyers should be ready for the seller to try and negotiate a few sections of the offer to better suit their needs. This process can go back and forth for quite a while until the parties finally agree or they both go their separate ways.

If the parties come to an agreement, they will sign the purchase contract. The buyer will then provide the seller with their earnest money deposit, which shows their intent to purchase the property as long as the remaining steps go as planned.

To ensure they’re not buying a property with underlying issues (such as lead walls or contaminated water), the buyer will hire an inspector to go through the house thoroughly. Every property has different systems and features, so the inspection may take time and could cover a great number of concerns. The most common areas an inspector will cover include the following:

The buyer is typically responsible for paying for the inspection, although they can require the seller to pay if it’s written in the purchase contract. The price of a home inspection will range from $200 to $496. “Going cheap” on an inspection is not recommended, as any defects the inspector finds could wind up saving the buyer hundreds to tens of thousands of dollars.

If the buyer will be paying for the property with a loan, they will need to obtain a mortgage through a financial institution. Assuming the buyer anticipated the down payment (by saving up for a down payment, ensuring their credit score is worthy, and the other recommendations from step 1) this process should go smoothly.

However, even if the buyer was pre-approved for a loan, the financer will require the property to be appraised by a neutral 3rd party appraiser. An appraiser is a person that is paid for by the mortgage provider. The appraiser’s job is to determine the property’s value in a non-biased way by going through every aspect of the property in painstaking detail. Mortgage providers require this as they want to ensure they are loaning for an investment that is worth it in the long run. As long as the appraiser gives a value of the property that is in line with the dollar amount of the loan the buyer is requesting, the buyer should be able to obtain the loan.

Once the mortgage application has gone through successfully, the parties have conducted a final walkthrough, and all contingencies have been removed, the parties can close on the home. At closing, the parties will be signing numerous documents and paying for the closing costs, among other activities. If the closing process goes off without a hitch, the buyer will be the official owner of their new home.

To be effective, a purchase agreement needs to contain the following elements:

The contract will contain space for recording the property’s full address, property type (condominium, triplex, single-family, etc.), and legal description. The home’s legal description can be found in the deed and should be copied over word-for-word.

Arguably the most important section of the contract, the purchase price is the full amount the buyer is willing to pay for the property. Also included in this section (or sometimes in its own section altogether) is how the buyer will finance the purchase; it covers whether the buyer will be paying in cash, receiving financing from the seller, or with a new mortgage (bridge loan, VA loan, fixed-rate, variable, etc.).

A contingency is a clause that states a certain condition must be met before a buyer goes through with the purchase. Depending on the property’s desirability and market state, the number of contingencies will vary greatly. Other than the offered price, contingencies are one of the most commonly negotiated terms of a purchase agreement.

The buyer pays the earnest money deposit to the seller upon signing the purchase agreement. It shows the seller that the buyer is wholly invested in purchasing the home and gives the seller the confidence to proceed with the deal. If the buyer backs out for a reason not covered by the contract, the seller gets to keep the deposit. A third party (such as a real estate brokerage or title company) often holds the deposit in a trust account.

The closing is the period in which the parties finalize the contract and officially transfer ownership of the property from the seller to the buyer. Typically both parties share in the closing costs, although the seller can expect to pay more because of the agents’ commissions (buyer and seller agents). Buyer closing costs are typically two to five percent (2-5%) of the property’s purchase price, whereas the seller’s closing costs can amount to between eight to ten percent (8-10%) of the purchase price.

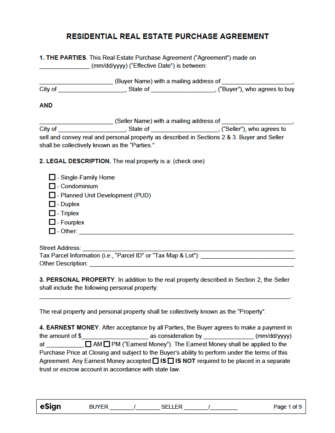

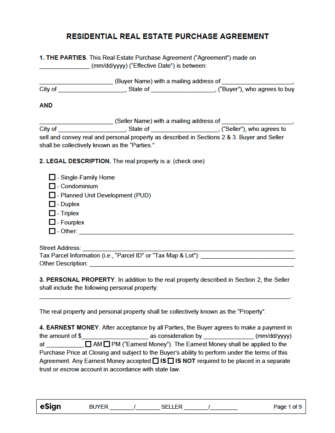

1. THE PARTIES. This Real Estate Purchase Agreement (“Agreement”) made on [MM/DD/YYYY] (“Effective Date”) is between:

[BUYER NAME] with a mailing address of

[BUYER MAILING ADDRESS] , (“Buyer”), who agrees to buy

[SELLER NAME] with a mailing address of

[SELLER MAILING ADDRESS] (“Seller”), who agrees to sell and convey real and personal property as described in Sections 2 & 3. Buyer and Seller shall be collectively known as the “Parties.”

2. LEGAL DESCRIPTION. The real property is a: (check one)

☐ – Single-Family Home

☐ – Condominium

☐ – Planned Unit Development (PUD)

☐ – Duplex

☐ – Triplex

☐ – Fourplex

☐ – Other: [OTHER PROPERTY TYPE] .

Street Address: [PROPERTY STREET ADDRESS] .

Tax Parcel Information (i.e., “Parcel ID” or “Tax Map & Lot”): [TAX PARCEL INFO] .

Other Description: [ADDITIONAL INFORMATION (IF ANY)] .

3. PERSONAL PROPERTY. In addition to the real property described in Section 2, the Seller shall include the following personal property:

[LIST INCLUDED PERSONAL PROPERTY] .

The real and personal property shall be collectively known as the “Property”.

4. EARNEST MONEY. After acceptance by all Parties, the Buyer agrees to make a payment in the amount of $ [PAYMENT] as consideration by [MM/DD/YYYY] at [TIME] ☐ AM ☐ PM (“Earnest Money”). The Earnest Money shall be applied to the Purchase Price at Closing and subject to the Buyer’s ability to perform under the terms of this Agreement. Any Earnest Money accepted ☐ IS ☐ IS NOT required to be placed in a separate trust or escrow account under state law.

5. PURCHASE PRICE AND TERMS. The Buyer agrees to purchase the Property by payment of $ [PURCHASE AMOUNT] ( [AMOUNT (IN WORDS)] Dollars) as follows: (check one)

☐ – All Cash Offer. No loan or financing of any kind is required to purchase the Property. The Buyer shall provide Seller is written third (3rd) party documentation verifying sufficient funds to close no later than [MM/DD/YYYY] at [TIME] ☐ AM ☐ PM. The Seller shall have three (3) business days after receiving such documentation to notify the Buyer, in writing, if the verification of funds is not acceptable. If the Buyer fails to provide such documentation, or if the Seller finds such verification of funds is unacceptable, the Seller may terminate this Agreement.

☐ – Bank Financing. The Buyer’s ability to purchase the property is contingent upon the Buyer’s ability to obtain financing under the following conditions: (check one)

☐ – Conventional Loan

☐ – FHA Loan (Attach Required Addendums)

☐ – VA Loan (Attach Required Addendums)

☐ – Other: [OTHER FINANCING] .

a.) In addition, the Buyer agrees, within a reasonable time, to make a good faith loan application with a credible financial institution;

b.) If the Buyer does not reveal a fact of contingency to the lender and this purchase does not record because of such nondisclosure after the initial application, the Buyer shall be in default;

c.) On or before [MM/DD/YYYY] , the Buyer will provide the Seller a letter from a credible financial institution verifying a satisfactory credit report, acceptable income, source of down payment, availability of funds to close, and that the loan approval ☐ IS ☐ IS NOT contingent on the lease, sale, or recording of another property;

d.) In the event the Buyer fails to produce the aforementioned letter or other acceptable verification by the date above in Section 5(c), this Agreement may be terminated at the election of the Seller with written notice provided to the Buyer within [#] days from the date in Section 5(c);

e.) The Buyer must obtain the Seller’s approval, in writing, to any change to the letter described in Section 5(c) regarding the financial institution, type of financing, or allocation of closing costs; and

f.) The Buyer agrees to pay all fees and satisfy all conditions promptly required by the financial institution to process the loan application. The Buyer agrees the interest rate offered by a lender or the availability of any financing program is not a contingency of this Agreement, so long as the Buyer qualifies for the financing herein agreed. The availability of any financing program may change at any time. Any licensed real estate agent hired by either party is not responsible for representations or guarantees regarding the availability of any loans, project, and/or property approvals or interest rates.

☐ – Seller Financing. Seller agrees to provide financing to the Buyer under the following terms and conditions:

a.) Loan Amount: $ [LOAN AMOUNT]

b.) Down Payment: $ [DOWN PAYMENT AMOUNT]

c.) Interest Rate (per annum): [RATE] %

d.) Term: [#] ☐ Months ☐ Years

e.) Documents: The Buyer shall be required to produce documentation, as required by the Seller, verifying the Buyer’s ability to purchase according to the Purchase Price and the terms of the Seller Financing. Therefore, such Seller Financing is contingent upon the Seller’s approval of the requested documentation to be provided on or before [MM/DD/YYYY] . The Seller shall have until [MM/DD/YYYY] to approve the Buyer’s documentation. Should the Buyer fail to obtain the Seller’s approval, this Agreement shall be terminated with the Buyer’s Earnest Money being returned within five (5) business days.

6. SALE OF ANOTHER PROPERTY. The Buyer’s performance under this Agreement: (check one)

☐ – Shall not be contingent upon selling another property.

☐ – Shall be contingent upon selling another property with a mailing address of

[PROPERTY MAILING ADDRESS] within [#] days from the Effective Date.

7. CLOSING COSTS. The costs attributed to the Closing of the Property shall be the responsibility of ☐ Buyer ☐ Seller ☐ Both Parties. The fees and costs related to the Closing shall include but not be limited to a title search (including the abstract and any owner’s title policy), preparation of the deed, transfer taxes, recording fees, and any other costs by the title company that is in standard procedure with conducting the sale of a property.

8. FUNDS AT CLOSING. The Buyer and Seller agree that before the recording can take place, funds provided shall be in one (1) of the following forms: cash, interbank electronic transfer, money order, certified check, or cashier’s check drawn on a financial institution located in the State, or any above combination that permits the Seller to convert the deposit to cash no later than the next business day.

9. CLOSING. This transaction shall be closed on [MM/DD/YYYY] at [TIME] ☐ AM ☐ PM or earlier at the office of a title company to be agreed upon by the Parties (“Closing”). Any extension of the Closing must be agreed upon, in writing, by the Buyer and Seller. Real estate taxes, rents, dues, fees, and expenses relating to the Property for the year in which the sale is closed shall be prorated as of the Closing. The Seller shall pay taxes due for prior years.

10. SURVEY. The Buyer may obtain a survey of the Property before the Closing to assure that there are no defects, encroachments, overlaps, boundary line or acreage disputes, or other such matters, that would be disclosed by a survey (“Survey Problems”). The Buyer shall pay the cost of the survey. No later than [#] business days prior to the Closing, the Buyer shall notify the Seller of any Survey Problems deemed to be a defect in the title to the Property. The Seller shall be required to remedy such defects within [#] business days and before the Closing.

If Seller does not or cannot remedy any such defect(s), Buyer shall have the option of canceling this Agreement, in which case the Earnest Money shall be returned to Buyer.

11. MINERAL RIGHTS. It is agreed and understood that all rights under the soil, including but not limited to water, gas, oil, and mineral rights, shall be transferred by the Seller to the Buyer at Closing.

12. TITLE. The Seller shall convey title to the property by warranty deed or equivalent. The Property may be subject to restrictions on the plat, deed, covenants, conditions, restrictions, or other documents noted in a Title Search Report. Upon execution of this Agreement by the Parties, the Seller will, at the shared expense of both the Buyer and Seller, order a Title Search Report and have it delivered to the Buyer.

Upon receipt of the Title Search Report, the Buyer shall have [#] business days to notify the Seller, in writing, of any matters disclosed in the report which are unacceptable to the Buyer. The Buyer’s failure to timely object to the report shall constitute acceptance of the Title Search Report.

If any objections are made by the Buyer regarding the Title Search Report, mortgage loan inspection, or other information that discloses a material defect, the Seller shall have [#] business days from the date the objections were received to correct said matters. If the Seller does not remedy any defect discovered by the Title Search Report, the Buyer shall have the option of canceling this Agreement, in which case the Earnest Money shall be returned to the Buyer.

After Closing, the Buyer shall receive an owner’s standard form policy of title insurance insuring marketable title in the Property to the Buyer in the amount of the Purchase Price, free and clear of the objections, and all other title exceptions agreed to be removed as part of this transaction.

13. PROPERTY CONDITION. The Seller agrees to maintain the Property in its current condition, subject to ordinary wear and tear, from the time this Agreement comes into effect until the Closing. The Buyer recognizes that the Seller and any licensed real estate agent(s) involved in this transaction make no claims as to the validity of any property disclosure information. The Buyer must perform their own inspections, tests, and investigations to verify any information provided by the Seller. Afterward, the Buyer shall submit copies of all tests and reports to the Seller at no cost.

Therefore, the Buyer shall hold the right to hire licensed contractors or other qualified professionals, to further inspect and investigate the Property until [MM/DD/YYYY] at [TIME] ☐ AM ☐ PM.

After all inspections are completed, the Buyer shall have until [MM/DD/YYYY] at [TIME] ☐ AM ☐ PM to present any new property disclosures to the Seller in writing. The Buyer and Seller shall have [#] business days to reach an agreement over any new property disclosures found by the Buyer. If the Parties cannot come to an agreement, this Agreement shall be terminated with the Earnest Money being returned to the Buyer.

If the Buyer fails to have the Property inspected or does not provide the Seller with written notice of the new disclosures on the Property, per this Agreement, the Buyer hereby accepts the Property in its current condition and as described in any disclosure forms presented by the Seller.

If improvements on the Property are destroyed, compromised, or materially damaged before Closing, the Agreement may be terminated at the Buyer’s option.

14. SELLER’S INDEMNIFICATION. Except as otherwise stated in this Agreement, after recording, the Buyer shall accept the Property AS IS, WHERE IS, with all defects, latent or otherwise. Neither the Seller nor their licensed real estate agent(s) or any other agent(s) of the Seller shall be bound to any representation or warranty of any kind relating in any way to the Property or its condition, quality or quantity, except as specifically outlined in this Agreement or any property disclosure, which contains representations of the Seller only, and which is based upon the best of the Seller’s knowledge.

15. APPRAISAL. The Buyer’s performance under this Agreement: (check one)

☐ – Shall NOT be contingent upon the appraisal of the Property being equal to or greater than the agreed upon Purchase Price.

☐ – Shall be contingent upon the appraisal of the Property being equal to or greater than the agreed upon Purchase Price. If the Property does not appraise to at least the amount of the Purchase Price, or if the appraisal discovers lender-required repairs, the Parties shall have [#] business days to re-negotiate this Agreement (“Negotiation Period”). If the Parties cannot agree during the Negotiation Period, this Agreement shall terminate with the Earnest Money being returned to the Buyer.

16. REQUIRED DOCUMENTS. Before the Closing, the Parties agree to authorize all necessary documents in good faith to record the transaction under the conditions required by the recorder, title company, lender, or any other public or private entity.

17. TERMINATION. In the event this Agreement is terminated, as provided in this Agreement, absent of default, any Earnest Money shall be returned to the Buyer, in full, within [#] business days with all parties being relieved of their obligations as set forth herein.

18. BUYER’S DEFAULT. Seller’s remedies shall be limited to liquidated damages in the amount of the Earnest Money outlined in Section 4. It is agreed that such payments and things of value are liquidated damages and are Seller’s sole and only remedy for Buyer’s failure to perform the obligations of this Agreement. The Parties agree that Seller’s actual damages in the event of Buyer’s default would be difficult to measure. The amount of the liquidated damages herein is a reasonable estimate of such damages.

19. SELLER’S DEFAULT. The Buyer may elect to treat this Agreement as canceled, wherein all Earnest Money paid by the Buyer hereunder shall be returned. The Buyer may recover such damages as may be proper, or the Buyer may elect to treat this Agreement as being in full force and effect, and the Buyer shall have the right to specific performance, damages, or both.

20. EARNEST MONEY DISPUTE. Notwithstanding any termination of this Agreement, the Parties agree that in the event of any controversy regarding the release of the Earnest Money, the matter shall be submitted to mediation.

21. DISPUTE RESOLUTION. The Buyer and Seller agree to mediate any dispute or claim arising out of this Agreement, or in any resulting transaction, before resorting to arbitration or court action.

22. GOVERNING LAW. This Agreement shall be interpreted under the laws in the State of [STATE NAME] .

23. TERMS AND CONDITIONS OF OFFER. This is an offer to purchase the Property per this Agreement’s above-stated terms and conditions. The Seller has the right to continue to offer the Property for sale and to accept any other offer before notification of acceptance. If this offer is accepted and the Buyer subsequently defaults, the Buyer may be responsible for paying the licensed real estate agent(s) compensation.

24. BINDING EFFECT. This Agreement shall be for the benefit of, and be binding upon, the Parties, their heirs, successors, legal representatives, and assigns, which, therefore, constitutes the entire agreement between the Parties. No modification of this Agreement shall be binding unless signed by both the Buyer and Seller.

25. SEVERABILITY. If any provision or part of this Agreement is invalid or unenforceable, only that particular provision or part so found, and not the entire Agreement will be inoperative.

26. OFFER EXPIRATION. This offer to purchase the Property as outlined in this Agreement shall be deemed revoked and the Earnest Money shall be returned unless the Seller signs this Agreement and a copy of this Agreement is personally given to the Buyer by [MM/DD/YYYY] at [TIME] ☐ AM ☐ PM.

27. ACCEPTANCE. The Seller warrants that the Seller is the owner of the Property or has the authority to execute this Agreement. Therefore, by the Seller’s authorization below, they accept the offer and agree to sell the Property per the terms and conditions outlined in this Agreement. The Seller has read and acknowledges receipt of a copy of this Agreement and authorizes any licensed real estate agent(s) to deliver a signed copy to the Buyer.

28. LICENSED REAL ESTATE AGENT(S). If the Buyer or Seller hired the services of licensed real estate agent(s) to perform representation on their behalf, they shall be entitled to payment for their services as outlined in their separate written agreement.

29. DISCLOSURES. It is acknowledged by the Parties that: (check all that apply)

☐ – There are no attached addendums or disclosures to this Agreement.

☐ – The following addendums or disclosures are attached to this Agreement: [LIST DISCLOSURES, IF ANY]

☐ – Lead-Based Paint Disclosure Form

30. ADDITIONAL TERMS AND CONDITIONS.

[ADD ANY ADDITIONAL DISCLOSURES HERE] .

31. ENTIRE AGREEMENT. This Agreement, together with any attached addendums or disclosures, shall supersede any other prior understandings and agreements, either oral or in writing, between the parties concerning the subject matter hereof and shall constitute the sole and only agreements between the parties concerning the said Property.

33. SIGNATURES.

_____________________________ [MM/DD/YYYY]

Seller’s Signature

[SELLER PRINTED NAME]

_____________________________ [MM/DD/YYYY]

Buyer’s Signature

[BUYER PRINTED NAME]

_____________________________ [MM/DD/YYYY]

Agent’s Signature

[AGENT PRINTED NAME]

_____________________________ [MM/DD/YYYY]

Agent’s Signature

[AGENT PRINTED NAME]